Modified Internal Rate of Return (MIRR): Definition, Formula & Example

Projects can be a great way for businesses to gain profit.

But at the same time, they are inherently costly and filled with risk. Because of this, companies and business managers will always try to calculate the cost and profitability of a project before going ahead with it.

That’s where the modified internal rate of return can come into use.

But what exactly is MIRR? And how can it help with the calculations of a business’s projects? We’ll take a closer look at this financial calculation in our in-depth guide.

Table of Contents

KEY TAKEAWAYS

- The modified internal rate of return is a financial calculator.

- It assumes that any positive cash flows gained from business operations are reinvested. This is at the cost of capital of the business.

- It also assumes that any initial outlays are financed at the financing cost of the business.

- MIRR can be used to rank investments or projects of an unequal size.

- The general consensus is that MIRR is a more realistic measure when compared to the more traditional internal rate of return (IRR).

- One of the drawbacks of using MIRR is that it is quite difficult to understand for people who don’t have a financial background.

What Is the Modified Internal Rate of Return?

The modified internal rate of return is a financial calculation. It works by assuming that any positive cash flows gained from the business are reinvested. This is at the business’s cost of capital. It also assumes that the initial outlays are financed at the business’s financing cost.

This is compared to the more traditional internal rate of return (IRR). IRR assumes that the cash flows from a project are invested at the internal rate of return. This means that MIRR more accurately shows the profitability and cost of a project.

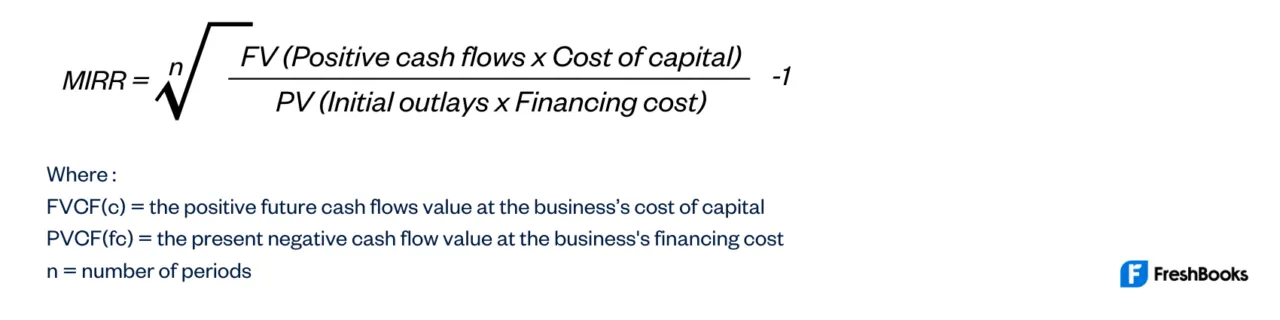

What Is the Formula for MIRR?

The formula for MIRR can be expressed as the following:

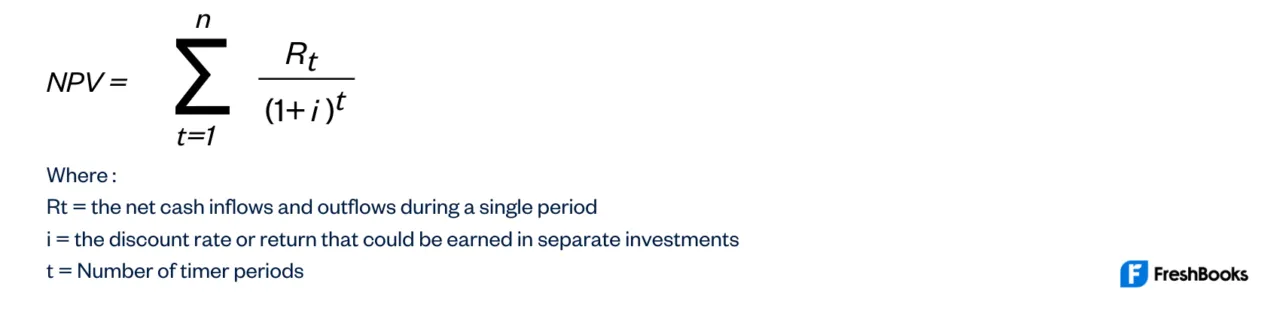

The internal rate of return is a discount rate. It is used to make the net present value (NPV). This is for all cash flows from a project equal to zero. Both the calculations of MIRR and IRR rely on the formula for NPV, which is as follows:

What Is an Example of MIRR?

Let’s say that Company X is running a two-year project. They have an initial outlay of $1,950 and their cost of capital is at 12%. This means that the returns in the first year will be $1,210 and $1,310 in the second year.

To find the MIRR, you’ll first need to do a basic IRR calculation of the project so that the NPV is 0 when IRR = 18.66%

NPV = 0 = -1950 + 1210 / (1+IRR) + 1310 / (1+IRR)2

We can then work out the MIRR of the project. We will assume that the positive cash flows from the project will be reinvested at 12% which is the cost of capital. That means that the future value of the positive cash flows when t = 2 can be calculated as:

$1,210 x 1.12 + $1,310 = $2,665.20

Next, you can divide the future value of the cash flows by the present value. This is of the initial outlay, which was $1,950. From here you can find the geometric return for two periods. The last step is then to adjust the ratio for the time period using the formula for MIRR.

MIRR = $2,665.20 / $1,950½ – 1 = 1.1691 – 1 = 16.91%

The IRR for Company X would show a very optimistic picture of the project’s potential. Whereas the MIRR helps to give an evaluation that is far more realistic.

What Is MIRR used for?

MIRR can be used in order to rank projects or investments of unequal size.

It allows project managers to alter the assumed rate of cash flow reinvestment from one stage to another during a project. This adds flexibility for any specific reinvestment rate and makes the reinvestment rate of positive cash flows far more valid when put into practice.

Limitations of Using MIRR

The main limitation of using the modified internal rate of return is that it asks for two additional decisions. These are the determination of the cost of capital, and the financing rate. Business owners may have some hesitation when involving these two additional estimates.

MIRR can also be difficult to understand for anyone who doesn’t have a financial background.

What Is the Difference Between MIRR and IRR?

The modified internal rate of return (MIRR) and the internal rate of return (IRR) are very similar concepts. MIRR was brought in with the aim of making a more realistic measure than IRR.

One of the assumptions that IRR makes is that any positive cash flows from a project are reinvested at the same rate at which they are generated. Whereas MIRR takes into consideration that the proceeds from the project’s cash flows will be reinvested at the external rate of return. This is normally set equal to the cost of capital of the company.

IRR can also provide two solutions which can lead to confusion and ambiguity. Whereas the MIRR calculation will only ever come back with a single solution.

Essentially, MIRR provides a more realistic view of the return on investment for a project when compared to the standard IRR. This is because MIRR is normally lower than the IRR.

Summary

Making use of the MIRR calculation is a useful way to figure out the realistic scope of your project. Because it directly accounts for a different reinvestment rate, it allows you to get a realistic picture of the profitability and success of a project. Plus, the more realistic evaluation nature of MIRR helps avoid any capital budgeting mistakes that can be caused by IRR.

FAQs on the Modified Internal Rate of Return

To find the modified internal rate of return, you have to take the present value of the cash flow of a project from the recovery phase. You then divide this by the project’s outlay and take the root of the result.

Finally, you multiply this result by one plus the cost of capital and subtract one. That gives you your MIRR.

If the investment and reinvestment rates of a project are the same as the NPV discount rate, then MIRR is the equivalent in percentage terms of the NPV. However, when the two rates are different, then MIRR is the better measure to use. This is because it directly accounts for reinvestment at the different rates.

MIRR is used in order to avoid distorting the cost of reinvested growth. This is from one stage to another in a project. MIRR allows you to adjust the assumed rate of reinvested growth in relation to the different stages of a project. Meaning you get a much more realistic view of the profitability and cost of a project.

Share: