Discounted Cash Flow (DCF) Overview, Formula & Calculation

Investments are classically a risky business.

Some investments skyrocket and make investors large amounts of capital. Others can flounder and leave the investor with less than they put in.

Investors will want to make sure that each investment opportunity is as close to a sure thing as possible. There are a number of different ways that they can calculate an investment’s value.

The discounted cash flow, or DCF, is one of those ways.

But what exactly is DCF? In this article, we’ll take a closer look at this valuation method. We’ll show you the formula, a calculation, and an example of the method in action.

Table of Contents

KEY TAKEAWAYS

- Discounted cash flow is a method of valuation. It helps an investor to calculate an investment’s value.

- This is done based on the investment’s future cash flows.

- You can figure out the present value of expected future cash flows by using a discount rate.

- The investment could result in a positive return if the DCF is above the current cost of the investment.

What Is Discounted Cash Flow?

Discounted cash flow is a method of valuation. It helps an investor to calculate an investment’s value. This is done based on the investment’s future cash flows.

Essentially, the aim of a DCF analysis is to calculate an investment’s value. It does this by basing how much money it may make over a period of time on projections.

The DCF can be used to help investors in their decision-making. Such as buying a company or a stock. It also helps business owners make capital budgeting decisions and operating capital expenditure decisions.

Why Is Discounted Cash Flow Important?

A DCF analysis can be used to figure out the money an investor would make from an investment. This is also when it has been adjusted for the time value of money. This means that a DCF analysis can be appropriate in any sort of investing situation. This is especially true when a person is paying money with the expectation of receiving more money in the future. This is also used when looking at annual cash flows.

So, for example, if there is a 5% annual interest rate, $10 in savings will be worth $10.50 over the period of time of a year. So if a $10 payment is delayed for a year, the value will be $9.50. This is because you cannot earn interest as it isn’t in your savings account.

How Does Discounted Cash Flow Work?

The DCF analysis works by finding the present value of expected future cash flows. This is done by using a discount rate. Investors can then use this concept of the present value of money. They can figure out if the future cost of their investments are equal or greater than the value of the initial actual investment.

If the value that is calculated is higher than the current cost of the investment, then the investment will be a plausible option.

To do a DCF analysis, an investor will have to make educated guesses about the future cash flows and the ending value of the investment, equipment, or any other financial asset involved. They must also figure out a fair discount rate for their DCF model. This will change depending on what the investment is.

A business will usually use a weighted average cost of capital (WACC) as the discount rate during a DCF analysis. This would be done when a business analyzes whether or not it should invest in a certain project or a new piece of equipment.

The weighted average cost of capital uses the average rate of return that shareholders expect for the given year.

DCF only works if you can properly assess the future rate of cash flow. If you can’t, or the project is extremely complex, then the DCF method won’t hold much value.

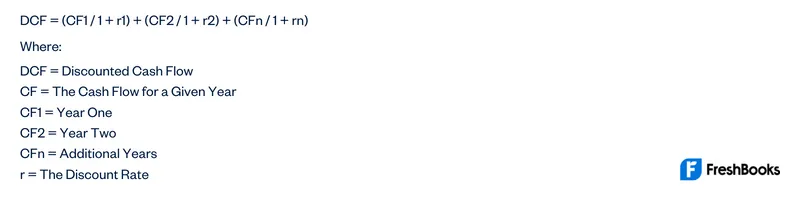

What Is the Discounted Cash Flow Formula?

The formula that is used for the discounted cash flow looks quite complicated. But in reality, it is a more basic formula than it looks at first. It is as follows:

An Example of the Discounted Cash Flow Method

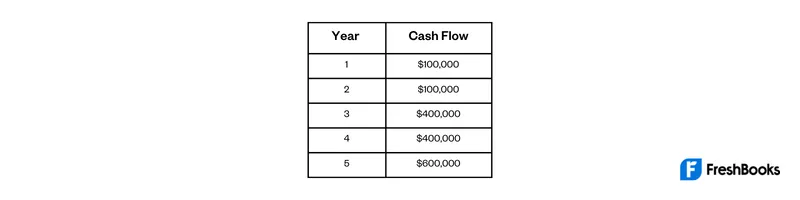

Let’s say that Company X is looking to invest in an enticing-looking project. The company’s weighted average cost of capital is 5%. This would mean that the discount rate used would be 5% also.

The initial investment in the project is $1.1 million, and the project will last for 5 years.

The estimated cash flows per year over the five years are as follows:

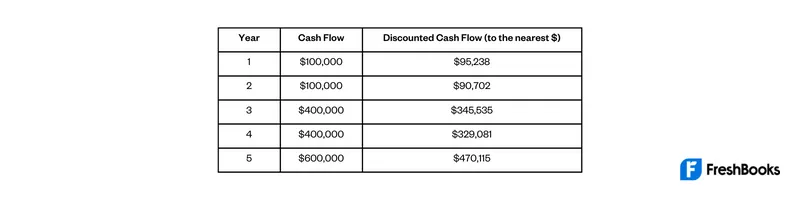

By using the discounted cash flow formula that we used earlier, you could see that the discounted cash flows for the project would be:

So if we added up all of the discounted cash flows, we’d get a value of $1,330,671.

If we take away the initial investment of $1.1 million, then you get a net present value of $230,671.

As this is a positive number, it indicates that the investment cost is worth it. This is because, according to the discounted cash flow, the project will make a positive cash flow that is above the initial investment cost.

However, let’s say that the cost of the initial investment was instead $1.4 million. That would mean that the net present value of the investment would have been -$69,327. This would indicate that the cost of investment would not be worth it.

What Are the Downsides of Using the Discounted Cash Flow Method?

The main issue that comes from using the DCF method is that it is based on assumptions. So to get an accurate reading, an investor would have to have strong finance knowledge. This is so they can correctly figure out the future cash flows of a particular investment

Future cash flows rely on various factors, including current market demand, technology, and any unforeseen circumstances. This makes it incredibly difficult to predict as many things can happen to change it accurately.

If investors or business owners estimate too high, then they can hurt their future profits. If they estimate too low then they would make the initial investment seem too costly, and perhaps miss an opportunity.

The fact that you have to assume a discount rate can also throw a potential spanner in the works.

Summary

The discounted cash flow method is a useful tool for both investors and business owners. It is a good way to judge the earning potential of investment opportunities or private equities. However, as with any investment, it shouldn’t be solely used by itself. The DCF works best when used alongside other valuation methods and financial models. This is because it is largely based upon assumptions when doing a cash flow analysis. And can therefore be inaccurate.

FAQs on Discounted Cash Flow

The time value of money is an assumption that the value of a dollar in the present day is more than the value of a dollar in the future. This is because a dollar today can be invested and make more money than simply having that same dollar tomorrow. This works over different time periods.

No, DCF is not the same as NPV. Although they are closely related, they are in fact two different things.

There is a key difference between these two cash flow models. Discounted cash flow is an income stream adjusted to incorporate the time value of money. Whereas a regular cash flow model is not adjusted to incorporate the time value of money.

Share: