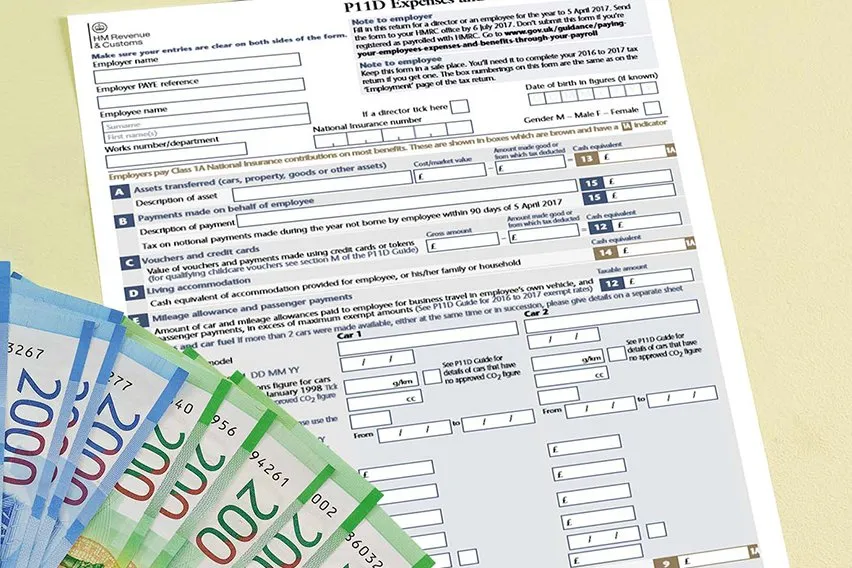

What Is a P11D Form? Expenses & Benefits for Employers

To report your expenses and benefits to the HMRC, you need a P11D form. Learn what a P11D form is and how to file one accurately.

If you’re an employer, you need to familiarise yourself with the P11D form. This magic form is your way of reporting expenses and benefits to the HMRC for more accurate tax calculations. That includes tax deductions too.

We’ll talk about:

- What the P11D form is

- What you should report on the form

- How to fill out the form for you and employees

Here’s What We’ll Cover:

What Needs to Be Included in a P11D Form?

What Doesn’t Need to Be Included on a P11D Form?

What Is a P11D form?

The annual P11D form is a tax form to report benefits, taxable expenses and payments that an employer pays tax on. You also report your “benefits in kind”. These are benefits you receive on top of your annual salary such as a beneficial loan, dental insurance, and childcare.

It’s important to report these as they affect your National Insurance contributions and that of your employees.

The taxable benefits and expenses you declare for each employee will affect their PAYE tax code.

A P11D form is always filed by the employer each tax year. If you’re a freelancer or contractor, you can file one for yourself.

What Needs to Be Included in a P11D Form?

Anything taxable that the company pays for needs to be reported on a P11D form. As a guide, the HMRC will ask that you report:

- Company cars including mileage allowances and fuel expenses

- Private car mileage and fuel expenses

- Any loans such as rail season ticket loans

- Telecommunication costs such as home telephones and mobile phone contracts

- Non-credit card payment expenses

- Medical insurance

- Non-business travel expenses

- Living accommodation

- Childcare costs

This list is not exhaustive. For a fully exhaustive list, head to the HMRC website.

What Doesn’t Need to Be Included on a P11D Form?

The HMRC made an exemption system for certain employment benefits and expenses you don’t need to report. These exempt expenses are:

- Business travel

- Credit cards used for business purposes

- Subscriptions

- Fees

- Businesses entertainment expenses

- Any reimbursed business expenses

How to File a P11D Form

You’ll need to file a P11D form if you’ve paid expenses or benefits to employees (or yourself).

At the end of each tax year, you need to submit a P11D form for each employee.

You can get a P11D form from the HMRC website or they may send them to you directly to complete.

You don’t need to submit a P11D form if you are paying tax on the benefits and expenses for your employees via your payroll system.

You must submit all eligible P11D forms by the filing deadline; 6th July. If you file late or incorrectly, you may be hit with hard penalties. At the moment, the penalty for late payment is £100 per month per 50 employees you have.

Penalties for incorrect returns vary. It’s human to make a common error so it’s reviewed on a case by case basis.

Using an online accounting system can make filing a P11D form much simpler. You’ll be able to identify the qualifying expenses and gather the information you need with one click.

The Structure of a P11D Form

On a P11D form, you can expect:

- Employee details inc name, National Insurance number, employee number etc

- Employer details inc PAYE tax code

- The tax year

You will need to fill in:

- Details of company assets that the employee or director are using

- Mileage allowance

- Payments and vouchers made on behalf of the employee or for the employee.

What Is a P11Db Form?

The P11D is relevant to almost all employers. It tells HMRC how much Class 1A National Insurance you need to pay on the expenses and benefits you report.

If you deduct the expenses from benefits via payroll, you don’t have to fill in a P11D form. But you do have to fill in a P11Db form still. This is because the HMRC still needs to calculate the National Insurance owed on those benefits.

Key Takeaways

The P11D form is a legal requirement for employers to report expenses and benefits to the HMRC. With intuitive tax software, you can make the process of filing this so much easier. Learn more about our UK tax filing capabilities.

For more tax guides like this one, head to our resource hub.

RELATED ARTICLES

Best Tax Software For 2025

Best Tax Software For 2025 VAT vs Sales Tax: What’s the Difference?

VAT vs Sales Tax: What’s the Difference? UK Payroll Tax: What It Is & How Does It Work?

UK Payroll Tax: What It Is & How Does It Work? What Is a Furloughed Worker? Coronavirus Furlough Guide

What Is a Furloughed Worker? Coronavirus Furlough Guide What Are CIS Deductions? Meaning & Calculation

What Are CIS Deductions? Meaning & Calculation What Is VAT Liability? A Beginner’s Guide

What Is VAT Liability? A Beginner’s Guide