Retained Earnings: Definition, Formula & Example

Retained earnings represent a company’s total earnings after it accounts for dividends. You calculate retained earnings at the end of every accounting period. This process serves many purposes.

Are you unsure what this earning number represents and how to calculate it? Well, you’ve come to the right place. This article goes over all the basics. You’ll learn to better understand and use retained earnings in your small business.

Table of Contents

What Is the Purpose of Retained Earnings?

Retained Earnings Formula and Calculation

Importance of Retained Earnings for Small Businesses

What Are Retained Earnings?

Retained earnings refer to a company’s net earnings after they pay dividends. The word “retained” means that the company didn’t pay the earnings to its shareholders as dividends. Instead, the money stays on the company’s balance sheet.

When a company loses money or pays dividends, it also loses its retained earnings. But when it creates new profits, the retained earnings increase. This is the company’s reserve money that management can reinvest into the business. It’s also sometimes called an “earnings surplus”.

You can think of retained earnings as net income. But the company has left this income for its business after paying out dividends.

A company reports retained earnings on a balance sheet under the shareholders equity section. It’s important to calculate retained earnings at the end of every accounting period. Companies also keep a summary report or retained earnings statement. This outlines retained earnings changes over time.

Factors That Affect Retained Earnings

Business management needs to understand the factors that can affect retained earnings. These factors can cause fluctuation in retained earnings.

This isn’t necessarily the result of a change in revenue flow. Rather, it could be because of paying dividends to shareholders, capital expenditures, or a change in liquid assets. It might also be because of different financial modelling, or because a business needs more or less working capital.

Here are factors that can cause an increase or decrease in total retained earnings:

- Scrip, cash, stock, or property dividends paid to stakeholders and owners

- Net revenue changes

- Errors/changes to beginning balance or any type of oversight

- Changes in tax rates

- Changes in overhead costs or cash flow needs

- Business strategy alterations

- Accounting principle changes, like transitioning from LIFO to FIFO

- Treasury stock selling for a lower price than the cost

- Deficit elimination related to reorganisation

Where Are Retained Earnings Located in Financial Statements?

By default, you’ll find retained earnings in the shareholders equity part of a balance sheet. You’ll also find the company’s ending balance here, which is usually calculated after a single accounting period. This helps investors learn more about the company’s financial health. Business accounts are usually broken down into 3 categories:

- Assets

- Liabilities

- Owner’s equity

Stockholders equity is further broken down into:

- Common stock

- Retained earnings

Most financial statements have an entire section for calculating retained earnings. But small business owners often place a retained earnings calculation on their income statement.

What Is the Purpose of Retained Earnings?

Retained earnings serve as a link between the balance sheet and the income statement. This is because they’re recorded under the shareholders equity section, which connects both statements.

A company can use retained earnings in many cases. They can boost their production capacity, launch new products, and get new equipment. Or they can hire new sales representatives, perform share buybacks, and much more.

Retained earnings are important for the assessment of the financial health of a company. It shows the net income acquired by the company over time. That net income lets the company distribute money to shareholders or use it to invest in its own growth.

Retained earnings are the historical profits a company has earned minus the dividends paid in the past. A company can use surplus cash for a range of things, such as:

- Dividend payments

- Full or partial income money distribution among business owners

- Payments to investors

- Expanding the business operation (like boosting the existing production capacity)

- Launching new products

- New partnerships

- Repaying outstanding debts or loans

Retained Earnings Formula and Calculation

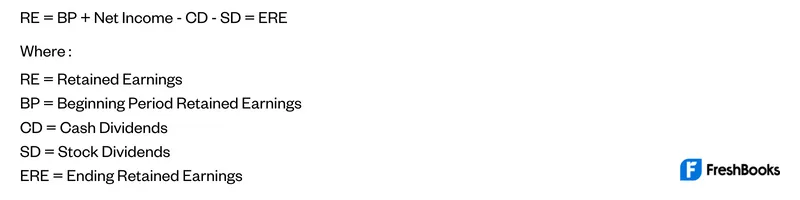

The retained earnings formula is:

Accounting software can calculate retained earnings. It will generate the balance sheet, retained earnings statement, and similar financials.

For manual calculations, you should take into consideration the following variables:

- Current retained earnings – the amount of retained earnings from the last calculation

- Net loss or profits – this number comes from the income statement for a current accounting period

- Dividends paid during the same accounting period

Retained Earnings vs. Revenue

Revenue and retained earnings are crucial for evaluating a company’s financial health. Each number highlights a different aspect of the bigger picture.

You’ll find revenue at the very top of your income statement. It’s often the most important number, as it describes how a company performs financially.

A company calculates its revenue during a specific period. This must come before the deduction of operating expenses and overhead costs. Some industries refer to revenue as gross sales because its gross figure gets calculated before deductions.

Retained earnings represent the portion of the cumulative profit of a company that the business can keep or save for later use. You can use this money in various ways, which we discussed above.

In some situations, the retained earnings can equal a company’s net profit. This can happen if the firm doesn’t gain its dividends in the current reporting year. It may also happen if a company doesn’t have deferred tax liabilities.

Retained earnings result from accumulated profits and the given reporting year. Meanwhile, net profit represents the money the company gained in the specific reporting period.

Analysis of Retained Earnings

One of the most important things to consider when analysing retained earnings is the change in the share of equity amount. If you have a decrease in retained earnings, it may show that your business’s revenue and activities are on the decline.

Before you make any conclusions, understand that you may work in a mature organisation. Shareholders and management might not see opportunities in the market that can give them high returns. For that reason, they may decide to make stock or cash dividend payments.

If your retained earnings increase, it could show:

- Accumulation of resources

- Effective management

- A favourable market

- Other factors that boost the money inflow from the company’s main activities

- Unclaimed cash or stock dividends

- Report errors

Note that accumulation can lead to more severe consequences in the future. For example, if you don’t invest in projects or stimulate the interest of investors, your revenue can decrease.

Also, your manufacturing goods may fall behind the competition. Why? Because you won’t be able to provide better quality or lower prices.

Importance of Retained Earnings for Small Businesses

Given the large number of financial reports any small business has, why is it necessary to do a retained earnings statement?

First of all, it’s helpful for investors. They need to know how much return they’re getting on their investment. The statement of retained earnings paints a clear picture of that.

Second, you’ll know how much money you have available to reinvest in your small business. If you never reinvest, you risk sitting stagnant. (But it’s also important not to put too much back and leave yourself short on cash flow. Good financial modeling can help with this.)

A retained earnings statement has all the information you need. It can serve as a blueprint for small business owners. And it can pinpoint what business owners can and can’t do in the future.

A retained earnings account is an internal source of financing. You can think of it as a savings account for the firm. Instead of paying money to shareholders or spending it, you save it so management can use it how they see fit.

The ultimate goal as a small business owner is to make sure you accumulate these funds. You can use them to further develop your business, pay future dividends, cover any debt, and more.

Example of Retained Earnings

You calculate retained earnings by combining the balance sheet and income statement information. For an example, let’s look at a hypothetical hair product company that makes $15 million in sales revenue.

Here are some elements that will get subtracted to calculate the RE:

- Direct or variable costs (i.e., staff salary, inventory, manufacturing costs, etc.) – $8 million

- Indirect or fixed costs (operating expenses, insurance, rent, marketing, training, etc) – $7.3 million

- Taxes – $300,000

- Dividends – $200,000

- Net profit – $1.4 million

To calculate RE, we’ll apply the formula:

Sales revenue ($15M) – variable costs ($7M) – fixed costs ($6.3M) – taxes ($300,000) = net profit ($1.4M) – dividends ($200,000) = retained earnings ($1.2M)

Many companies publicly show their retained earnings. For example, Apple has retained earnings for 2021 of $5.52B. In 2020, the company’s surplus cash was $14.966B. That means it experienced a 62.84% decline in 2021.

Retained Earnings Limitations

Much like any other part of a business, there can be downsides to retained earnings. Retained earnings are a shaky source of funds because a business’s profits change. And you can even have negative retained earnings.

Also, your retained earnings over a certain period might not always provide good info. Especially for analysts. For instance, say they look at your changes in retained earnings over the years. This might only reveal a trend showing how much money your company adds to retained earnings.

Investors want access to more information. They want to know about the returns generated by retained earnings. And they want to know whether they can do better with other investments. An investor may be more interested in seeing larger dividends instead of retained earnings increases every year.

With retained earnings, equity members might lose out on dividends. Using this finance source too much can create dissatisfaction among members and impact the goodwill of the firm. A company shouldn’t avoid giving dividends payouts just to amass more retained earnings. Doing so will establish a poor track record.

Too many retained earnings can also lead to undercapitalisation. This isn’t the best financial planning step. But you can remedy it by dispersing more dividends. You can also move the money to cash flow to pay for some form of extra growth.

Finally, there is a monopoly danger associated with excessive retained earnings. When a company abides by this policy, it may assume a giant size over a specific period and crush smaller competitors.

Key Takeaways

Retained earnings refer to the cumulative positive net income of a company after it accounts for dividends. You may use these earnings to further invest in the company or buy new equipment. You can also finance new products, pay debts, or pay stock or cash dividends.

A big retained earnings balance means a company is in good financial standing. Most growing companies avoid paying dividends. Instead, they use retained earnings to invest more in their business growth.

Want to make sure your retained earnings calculations are accurate? Then take good care of your balance sheet and income statements. Accounting software like FreshBooks can help with that. You can learn more about FreshBooks by visiting their official website.

FAQs on Retained Earnings

Are Retained Earnings an Asset or Equity?

Retained earnings are equity. You record them in the equity section of the balance sheets. However, company owners can use them to buy new assets like equipment or inventory.

What Is the Difference Between Retained Earnings and Net Income?

Those terms often overlap, but they aren’t the same. Net income is the amount of money a company has after subtracting revenue costs. Retained earnings are the cash left after paying the dividends from the net income.

What Is the Difference Between Retained Earnings and Equity?

A company’s equity refers to its total value in the hands of founders, owners, stakeholders, and partners. Retained earnings reflect the company’s net income (or loss) after the subtraction of dividends paid to investors.

What Is the Relationship Between Dividends and Retained Earnings?

Dividends are often distributed as stock dividends or cash dividends. Both reduce the company’s retained earnings.

Paying the dividends in cash causes cash outflow, which we note in the accounts and books as net reductions. Stock dividend payments don’t affect the cash outflow. But it does transfer retained earnings to common stock.

How Do Retained Earnings Affect Net Income?

Retained earnings increase as the company’s net income increases. If a company receives a net income of $40,000, the retained earnings for that month will also grow by $40,000.

RELATED ARTICLES

Feasibility Study: Meaning, Types & Process

Feasibility Study: Meaning, Types & Process What Is Direct Debit Guarantee & Direct Debit Rules?

What Is Direct Debit Guarantee & Direct Debit Rules? What Is a Risk-Free Rate of Return? Definition & Example

What Is a Risk-Free Rate of Return? Definition & Example What Is a Control Account?

What Is a Control Account? What Is a Purchase Requisition Form? A Guide

What Is a Purchase Requisition Form? A Guide What Is Net Book Value? Formula & Importance

What Is Net Book Value? Formula & Importance