Financial Reporting Software to Help Your Business Grow

Financial Reporting tools that show you how your business is performing. From a simple dashboard to robust reports, business performance is always transparent to you and your accountant.

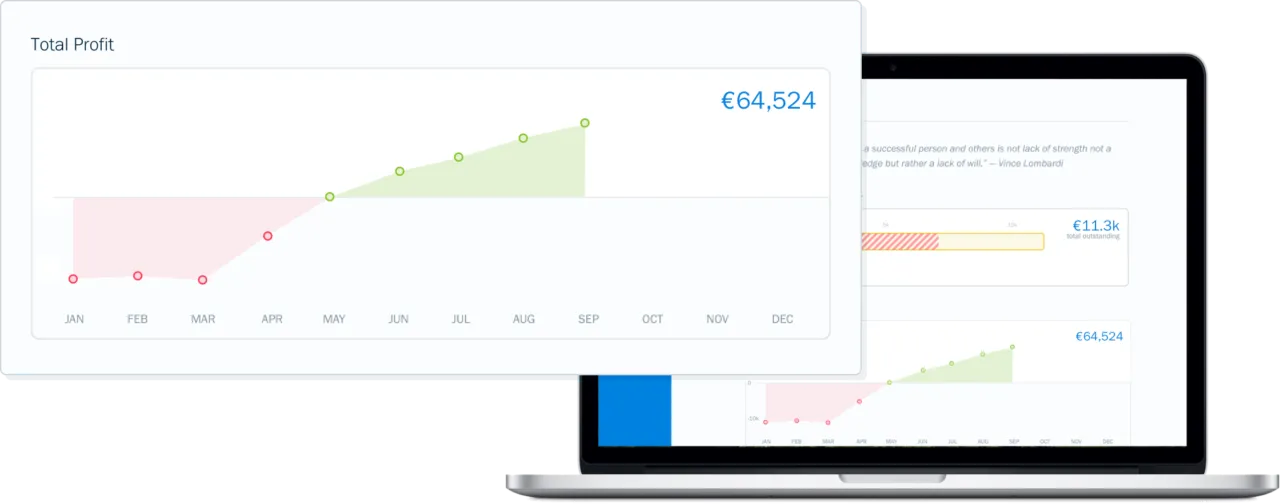

The Dashboard, Your Daily Answer to “How’s Business?”

With a high-level snapshot of your financials, the Reports Dashboard shows revenue, profit, and expenses. You’ll know which clients need invoicing and see unbilled revenue you’re missing out on.

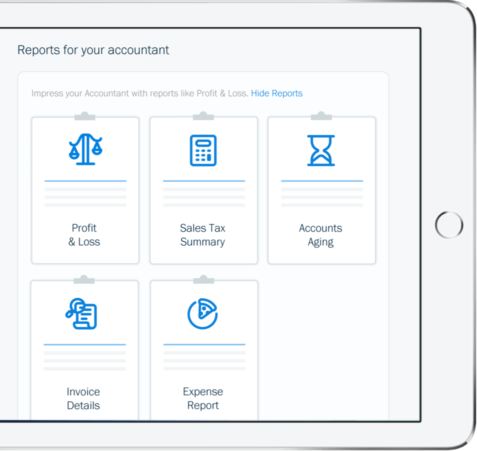

Ready-Made Financial Reports When You Need Them

FreshBooks financial reporting software fills makes it easy to access important reports (eg. Profit and Loss and Expense Report), saving you time and taking the stress out of tax season.

Confidently Tackle Tax Time

With FreshBooks financial reporting software, you’ll be confident when tax time rolls around. From the money you’ve collected to the taxes you’ve already paid, and everything in between, your financial data is all in one place.

A Dashboard + Reports to Keep You On Track

Compared to other financial reporting software solutions, FreshBooks combines powerful cloud accounting software with easy-to-understand business performance reports:

- Colour-coded breakdown of spending

- Summary of most recent activity

- Profit and Loss Report

- Sales Tax Summary Report

- Accounts Aging Report

- Payments Collected Report

- Accounting Reports (General Ledger, Trial Balance, Chart of Accounts)

- Expense Report

- Invoice Details Report

- Report filtering by client, team member, or date

- Save, export or print financial reports for your accountant

- Time Tracking and Project Profitability reports

See the other ways FreshBooks financial reporting software delivers powerful business insights >

Did You Know…

Frequently Asked Questions

Absolutely. FreshBooks financial reporting software makes it easy to keep a close eye on the bottom line of your company, thanks to Profit & Loss Reports (also known as income statements) you can whip up in seconds. An income statement or Profit & Loss Report is one of the three important financial reporting statements used to track a company’s performance and results over a specific accounting period. The other two key financial statements are the Balance Sheet and the Cash Flow Report.

You can run a Profit & Loss report for any time range by going to the Reports section of your account and selecting “Profit & Loss” under “Accounting Reports”. Your Profit & Loss report will be broken down into several sections. The “Income” section will be broken down by Sales, Other Income, and Cost of Goods Sold. The “Expenses” section will display all of your Expenses during your selected date range. The “Net Profit” section will display your Income minus your Expenses to give you a total amount earned.

Want to grow your business even faster? Check out this free eBook: Unlock Your Growth Potential with Working Capital

Get a quick review of generating reports in FreshBooks with this short video.

Yes! The Client Statement report gives you key information like an outstanding balance, Invoices and Payments history, and available Credits. Understanding client behaviours is an important part of financial reporting. A proper analysis of your books is essential for financial reporting and business decision making.

You can run an Account Statement for a client by going to the “Clients” section of your FreshBooks account and then clicking on the client you would like to run a statement for. You can then select “More Actions” and click on “Generate Statement” to get your Client Statement report.

While not a typical financial statement, once you’ve generated your Client Statement for your preferred date range, you can send the report to your client, export it to Excel, or print it.

Looking for more? Read this helpful article: Financial Reports: The Most Important Numbers to Grow Your Business

Your financial reporting solution isn’t complete without the Time Entry Details Report. It shows you all the time you and your team (including contractors) have tracked over a specified period. You can customise this report to show you a particular range of time entries, along with their notes, using optional filters.

You can run a Time Entry Details Report in the Reports section of your FreshBooks account by clicking on Time Entry Details under Time Tracking Reports. Once you’ve run your report, you can adjust your view through a number of filters: Date Range, Group, Client, Currency, and Amount.

Once you’ve adjusted your report to a view that makes the most sense for you, you can then export your report to Excel or print it.

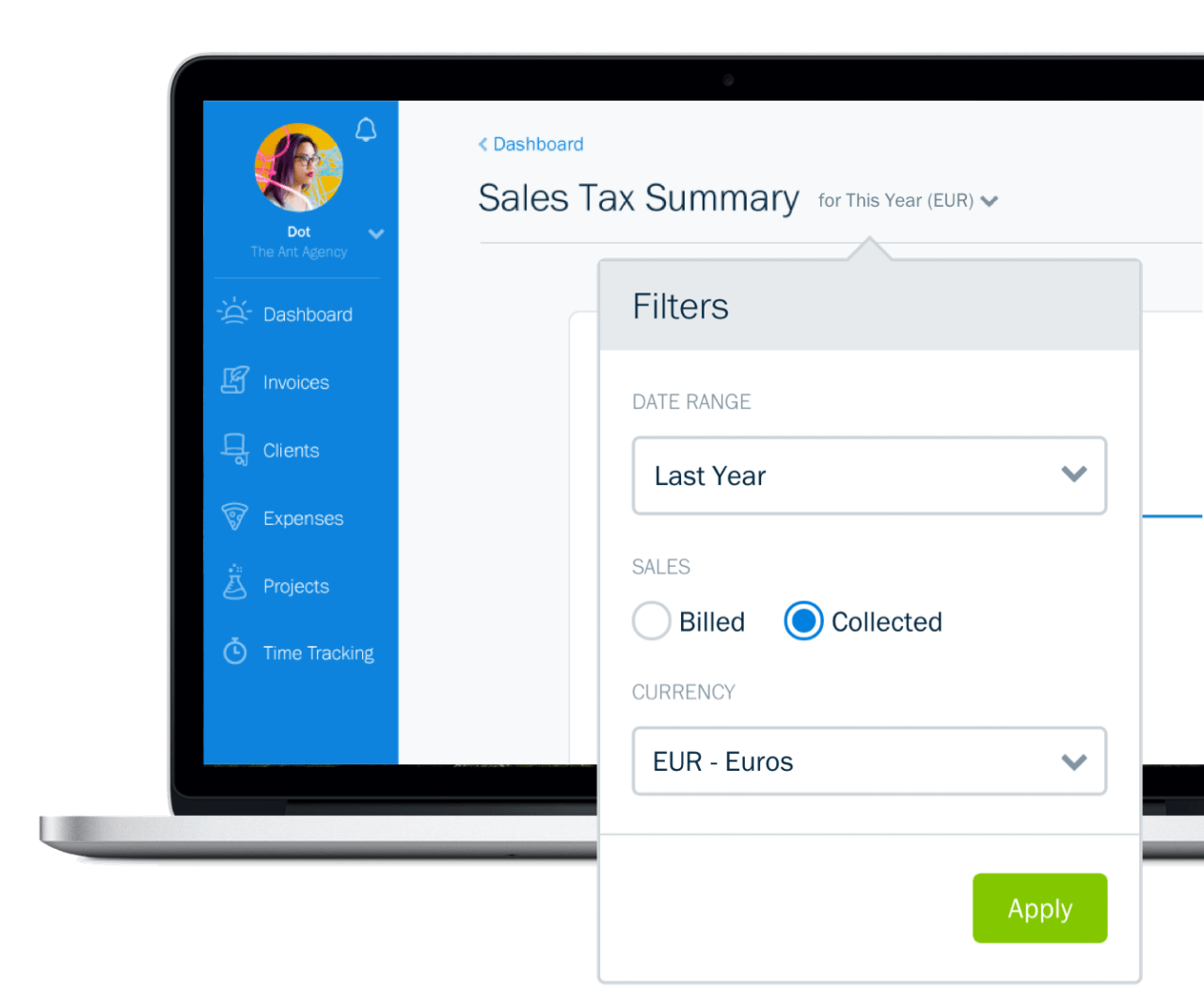

Yes! The Sales Tax Summary report shows you how much you’ve paid in taxes on Expenses over a certain period and how much you’ve collected. In terms of financial reporting, the sales tax report is essential at tax time.

You can run a Sales Tax Summary Report and other financial reports in the Reports section of your FreshBooks account by selecting Sales Tax Summary under Accounting Reports.

Once you’ve generated your report, you can adjust your view by clicking on Filters under Settings. From here, you can adjust the Date Range, Sales type (Billed vs. Collected), and Currency type.

The top left of your report will show you Total Billed or Total Collected, giving you the total overall value you have either invoiced for or collected during your selected date range.

When you have adjusted your report using the appropriate filters, you can export your report to Excel or choose to print it.

Cash Flow Reports (or cash flow statements) shows you exactly how much cash your company has on hand with money entering and leaving your business. This includes any operating expenses or other expenses that depreciate over time. A Cash Flow Report is one of the three important financial statements used for reporting the financial performance or results of your company over a specific accounting period. The other two key financial statements are the Balance Sheet and the Profit & Loss Report (income statement).

Get everything you need to know about the cash flow report here.

Get a quick review of generating reports in FreshBooks with this short video.

Check out how ridiculously easy to use FreshBooks invoicing is, or learn more about FreshBooks.