FreshBooks vs QuickBooks

FreshBooks is a QuickBooks alternative that’s actually easy to use. Picture easier invoicing and faster payments, building stronger relationships with your clients, and easily seeing the health of your business. All by using a platform that was built especially for businesses like yours. Oh, and there’s an industry-leading customer support team—like, real humans that pick up when you call—imagine that

Offer exclusive to this page: Get 90% Off for 4 Months

Offer terms:

Monthly Plans

Get 90% off a Lite, Plus or Premium Plan for 4 months. After the 4-month promotional period, you will be billed at full price for the plan you have selected.

Yearly Plans

The total price for a Yearly plan is billed at the time of purchase. It includes both the monthly discount outlined above, as well as an additional 10% discount for selecting a yearly plan.

Promotional offers for both monthly and yearly plans are for a limited period. New customers only. Cannot be combined with other offers. No free trial period is included when availing this promotional discount. FreshBooks reserves the right to change this offer at any time.

FreshBooks vs. QuickBooks

Easy to Use, Stellar Support, It’s a No-Brainer

✔ FreshBooks vs ✘ QuickBooks

FreshBooks is better than QuickBooks Online for project-based small businesses. Effortlessly manage your books and run your business using FreshBooks’ intuitive platform.

Don’t just take it from us: According to PC Mag, QuickBooks is the MOST confusing office app: “The results speak for themselves. Google queries find QuickBooks, the venerable office accounting software, to be the most unfathomable.”

|

Product Comparison

|

|

QuickBooks

|

|---|---|---|

|

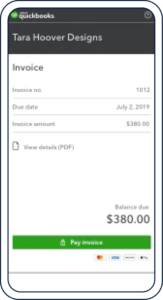

Product Screenshot

|

||

|

Monthly Price

|

$20 AUD

|

$25 AUD

|

|

Free Trial

|

Free 30-Day Trial Included

|

Free 30-Day Trial Included

|

|

Easy to Use Interface

|

|

|

|

Live Customer Service

|

|

|

|

Project Management

|

|

|

|

Client Communication

|

|

|

|

Unlimited Invoicing

|

|

|

|

Recurring Invoicing

|

|

|

|

Checkout Links

|

|

|

|

Proposals & Estimates

|

|

|

|

Online Payments

|

|

|

|

Expense Tracking

|

|

|

|

Double-Entry Accounting

|

|

|

|

Business Health Reports

|

|

|

Only available to new subscribers via this page. See offer details

FreshBooks vs. QUICKBOOKS

Easier Accounting and Exceptional Support,

Sound Like the Fresh Start You’ve Been Looking For

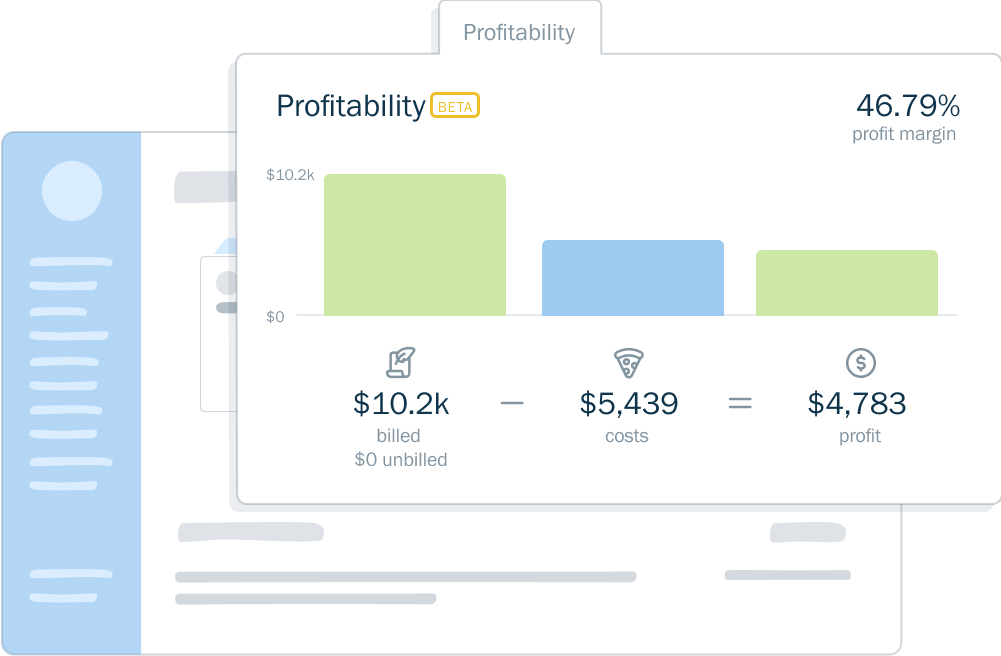

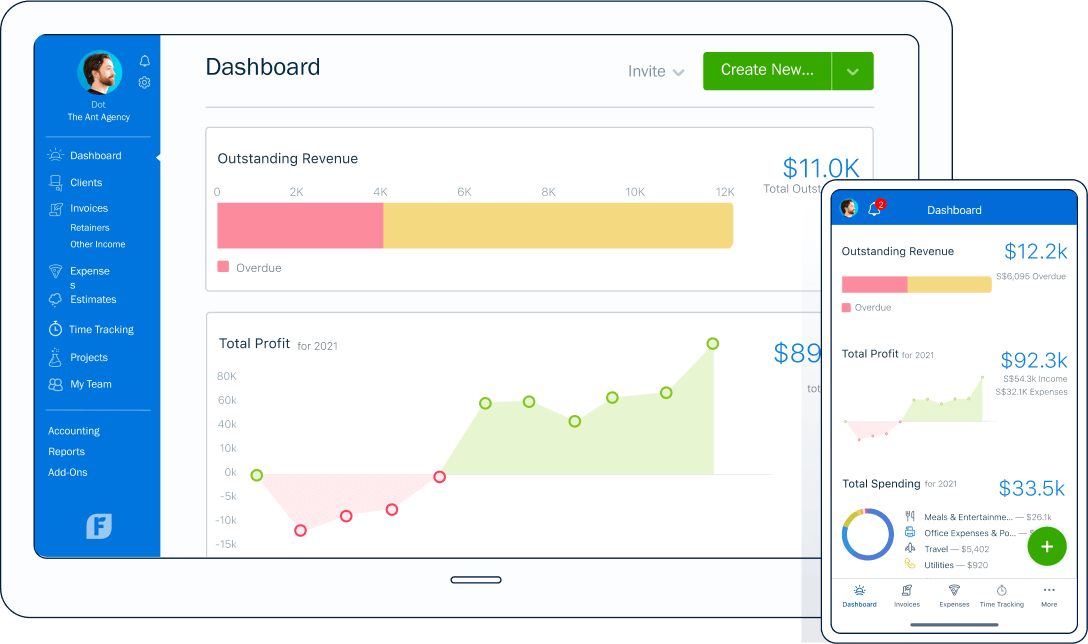

From sending out professional-looking proposals to automatic payment reminders, FreshBooks ensures you easily maintain business operations and streamline processes. Plus, it simplifies accounting, so you have less to do at tax time. And if you need support, our award-winning team always has your back.

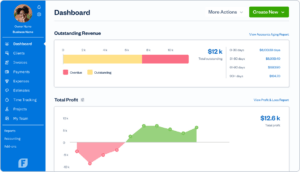

Easy-To-Use Interface

You shouldn’t need an accounting degree to do your books, Unlike QuickBooks, the FreshBooks simple yet robust interface has a very short learning curve, so you and your team can hit the ground running, and with easy migration from other platforms (including spreadsheets and paper and pen accounting), you’ll be saving time in no time.

Superior Customer Service

Ya know who always picks up and never transfers you when you call FreshBooks? A real person. QuickBooks are known for their slow and painful customer service, while FreshBooks has the best rating for customer support among all competitors, at 91%.

Switching Made Easy

Our support team is here to make switching to FreshBooks from any other software (even spreadsheets) super easy, with no interruptions to your business. No wonder over 30 million businesses have used FreshBooks.

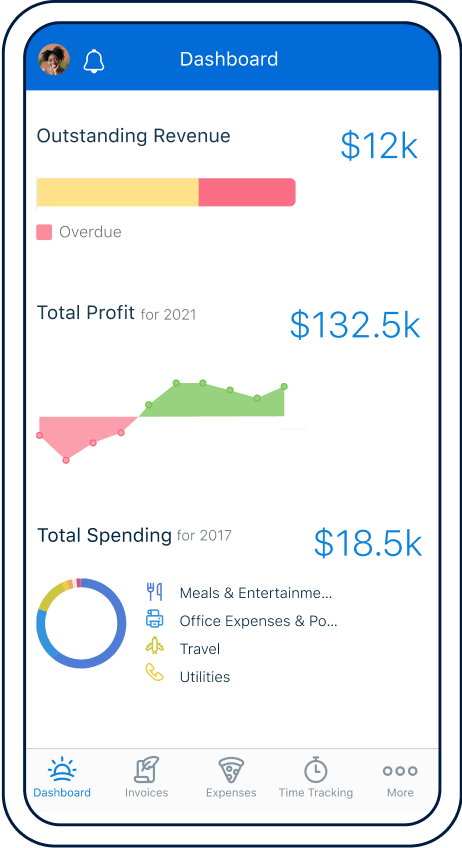

Win and Impress New Clients

FreshBooks makes it easy to manage everything client-related. From creating professional proposals and invoices to collaborating with clients, you’ll have all the tools you need to easily impress prospective clients and stay on top of billing, payments, and projects. All without paying extra for project and client management software (unlike QuickBooks Online). p.

Easy-to-Use Accounting & Bookkeeping Features

Tired of Confusing Accounting Software? FreshBooks Is the

Quickbooks Alternative That’s Easy to Use.

You don’t need an accounting degree to use FreshBooks. With the best customer support in the industry, it’s easy to see why QuickBooks customers switched to FreshBooks.

The user interface for Quickbooks is awful. Even our CPA can’t remember how to perform certain actions in Quickbooks because nothing is intuitive.

Date of experience: September 2022

Unless you’re on the most expensive subscription [with QuickBooks] much of the functionality is locked away. What they don’t tell you though is that if you want to email that quote to more than one person you have to subscribe to the most expensive package.

Date of experience: October 2022

Would never recommend this online accounting software. Inputting information is like typing on my grandmother’s typewriter. The slowest software I’ve had to endure, just horrible.

Date of experience: September 2022

The support is basically non-existent. Also, there is just no reason that they haven’t implemented more customization options for how long this software has been out. They also make syncing with other programs sound good, but then limit what can actually be done on the back-end.

Date of experience: August 2022

Award-Winning Customer Support

- Help From Start to Finish: Our Support team is highly knowledgable and never transfers you to another department.

- 4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews

- Global Support: We’ve got over 100 Support staff working across North America and Europe

Frequently Asked Questions

FreshBooks’ features automate most of your accounting so you can spend more time focusing on your work and your clients. You can have invoices automatically generated and sent, expenses automatically tracked, and even have your payments automatically recorded, all without you lifting a finger.

Instead of wasting time labouring over manual inputs or struggling to keep track of bulky receipts, you can use the FreshBooks accounting application to safely automate your accounting.

With FreshBooks, you can rest easy knowing that your accounting struggles are behind you.

FreshBooks vs QuickBooks: When it comes to accounting software, there is no comparison. We simply couldn’t recommend QuickBooks with a clear conscience.

Learn how easy FreshBooks is to use in this 30-second video.

The short answer is YES!

The long answer is as follows:

When setting up a FreshBooks account, you can start fresh, or transfer over existing data from any previous software like QuickBooks, HoneyBook QuickBooks Online, Zoho Books, or Xero. If you’re not a fan of manual entry, Clients, Expenses, and Items can be imported by you with the steps below. For Taxes, you can email us the below details, and we’ll take care of it for you.

NOTE: If you choose a Select Plan, your information will be migrated for you by one of our account specialists.

Below are the types of data FreshBooks can import:

Clients: Clients can be imported using the steps here yourself.

Expenses: You can now import Expenses yourself with the steps here.

Items: Import Items using the steps outlined here.

Taxes: For Taxes, you can put together a CSV file for each type of data with the required columns below first. Then send this from your owner’s email (that matches your account) with written permission for us to upload.

Required Fields

- Tax Name – i.e. ‘HST’

- Percentage – i.e. ’13’ for a 13% tax

Optional Fields

- Tax Number – Government-registered tax number

Vendors: Import Vendors using the steps outlined here.

The main difference between FreshBooks pricing and QuickBooks pricing is:

1) We don’t charge extra for basic features. FreshBooks offers essential features on all plans:

- Unlimited Customized Invoices

- Unlimited Expense Entries

- Unlimited Time Tracking

- Unlimited Estimates

You sure can.

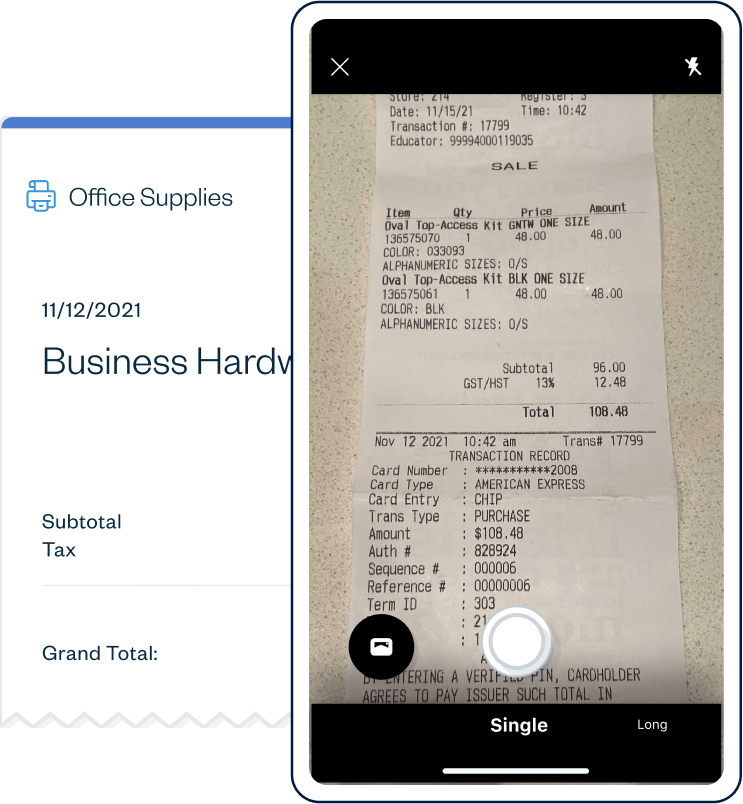

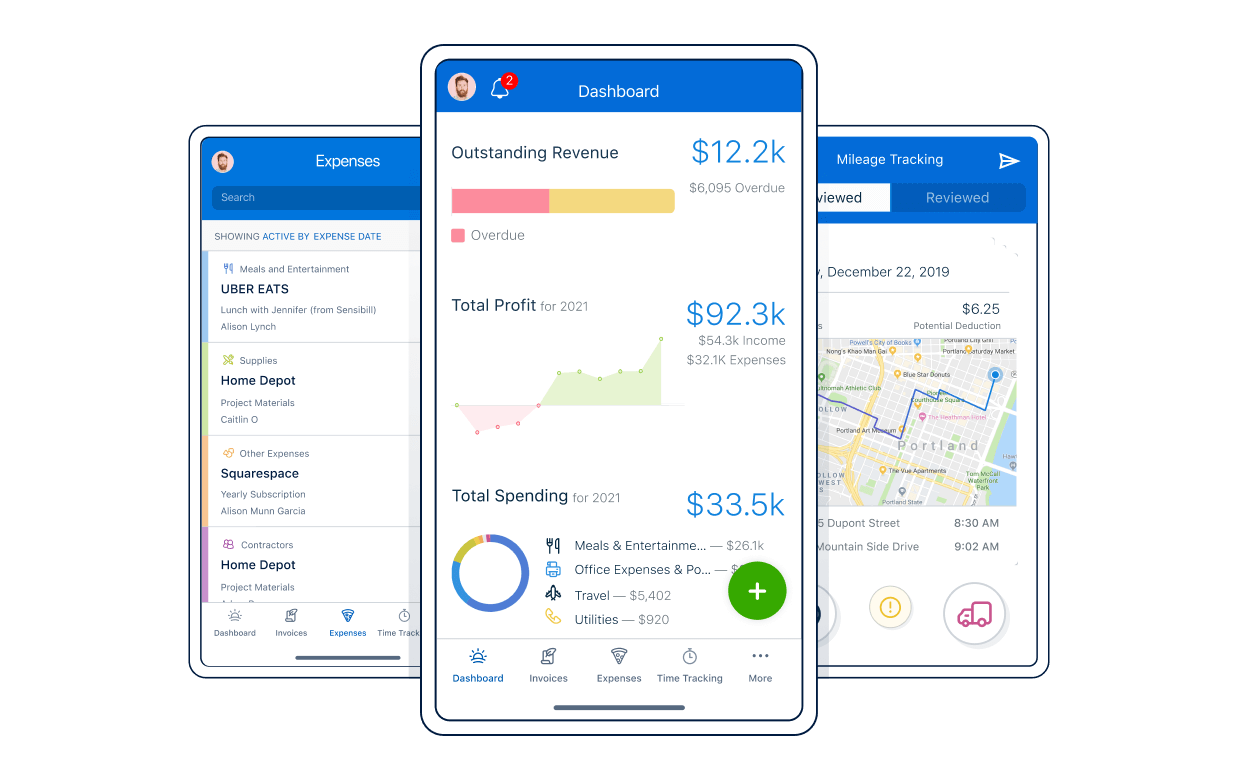

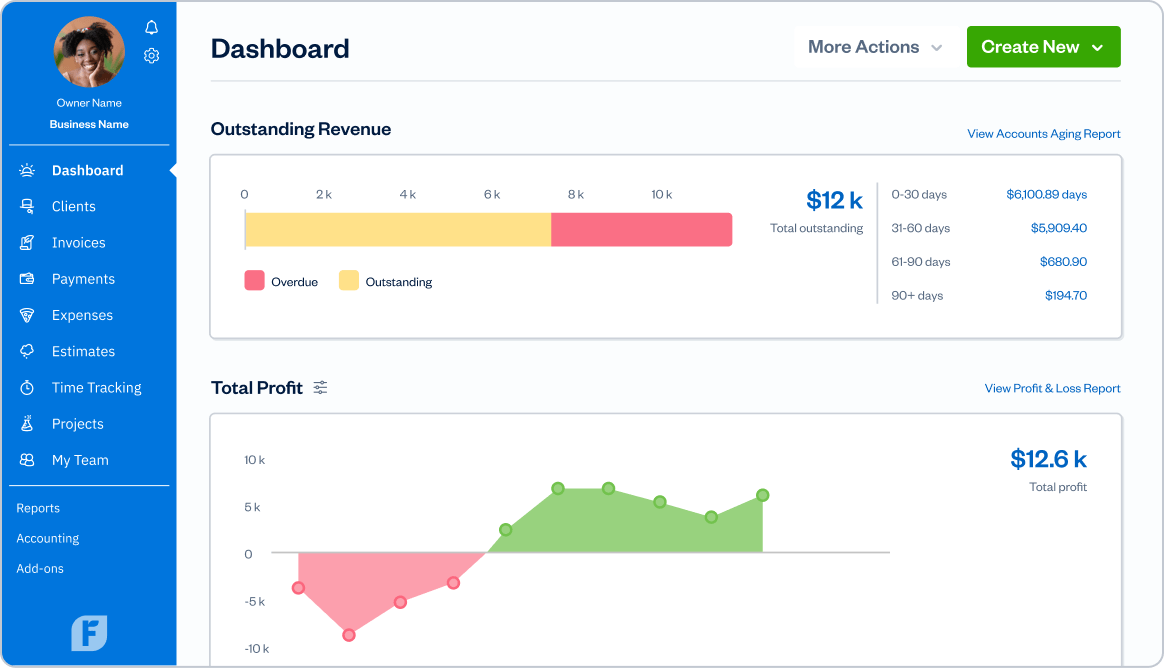

Many FreshBooks customers have service-based businesses that have them constantly on the go. Not all accounting software options allow you to bring your software along with you while serving billable clients.

FreshBooks offers mobile access with iOS (iPhone Mobile) and Android Mobile apps that let you painlessly invoice your clients and track expenses wherever and whenever you need to. FreshBooks also has mileage tracking on iOS (coming soon to Android).

Now you can bring your account everywhere. It can be easily accessed from any device, from your PC (Windows desktop) or Mac desktop to your mobile phone.

Being able to create and send invoices on the go means no delays and no accounting headaches waiting for you. You can use the FreshBooks automated bookkeeping software wherever you have access to the internet, so let FreshBooks take care of your invoicing worries while you sit back and relax.

With automated bookkeeping software like FreshBooks, you can take it easy as you travel and rely on real-time notifications to keep you updated on billing and invoicing. From business trips to business lunches, keeping track of your payments will be a piece of cake. This mobile access is all part of your free trial too!

Learn how easy it is to use the FreshBooks mobile app in this 30-second video.

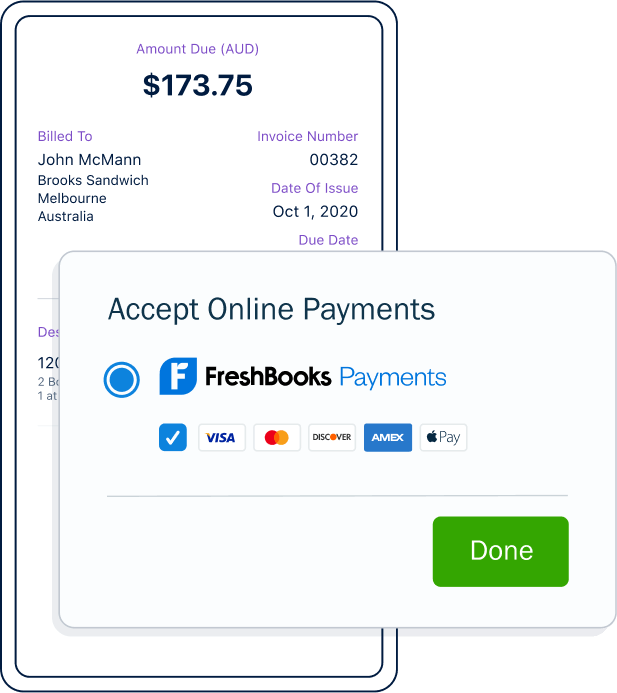

There are a number of payment processors and payment options you can choose through FreshBooks. FreshBooks integrates with a number of payment processors so that you can choose the payment method that works best for you and your business. Whether you want to accept credit card payments, set up bank transfers, or get paid through FreshBooks Payments, you can easily set up the method you prefer. You can also set up different payment methods for different clients, depending on what suits them best.

The payment providers we utilize are WePay, Stripe, and PayPal in order to provide the following payment methods:

- Major credit cards

- Apple Pay

- Google Pay

- PayPal

- FreshBooks Payments

- Stripe

- Bank Transfers

Online payments get you paid 2x faster, but did you know you can get paid even faster and more often with the right Invoice Payment Terms?

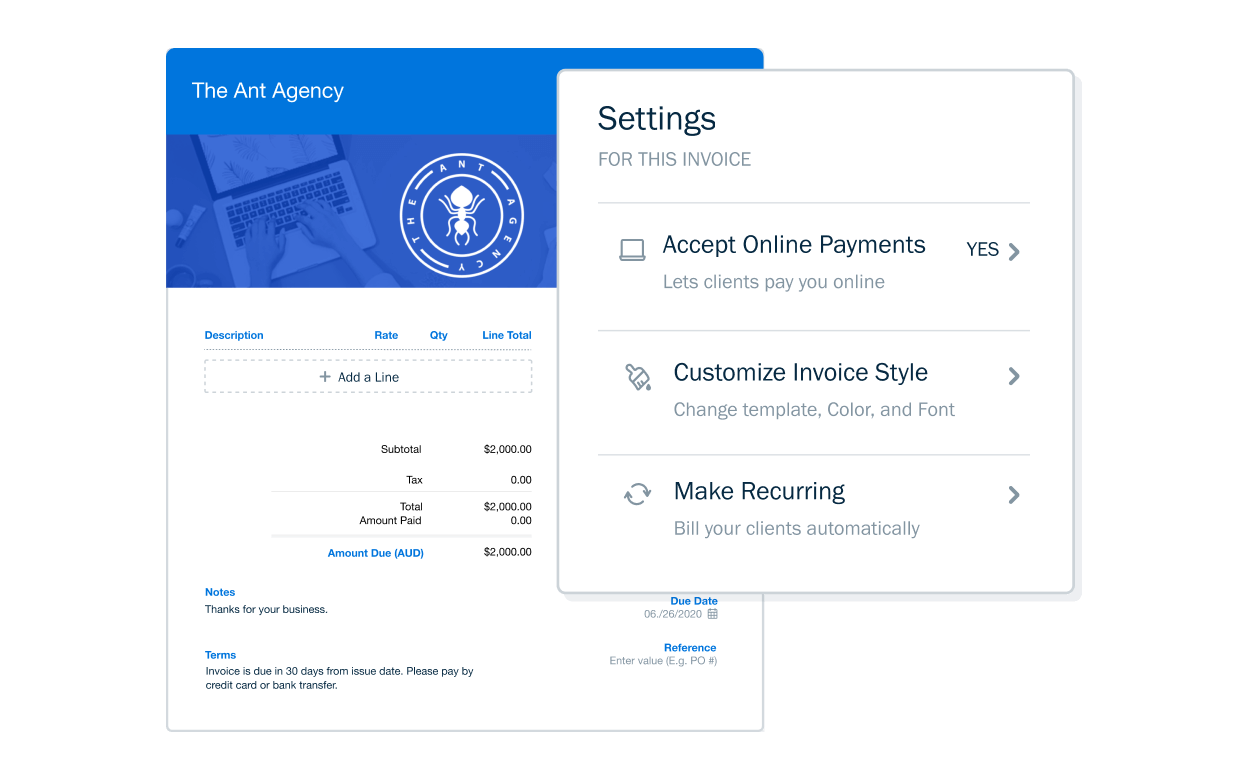

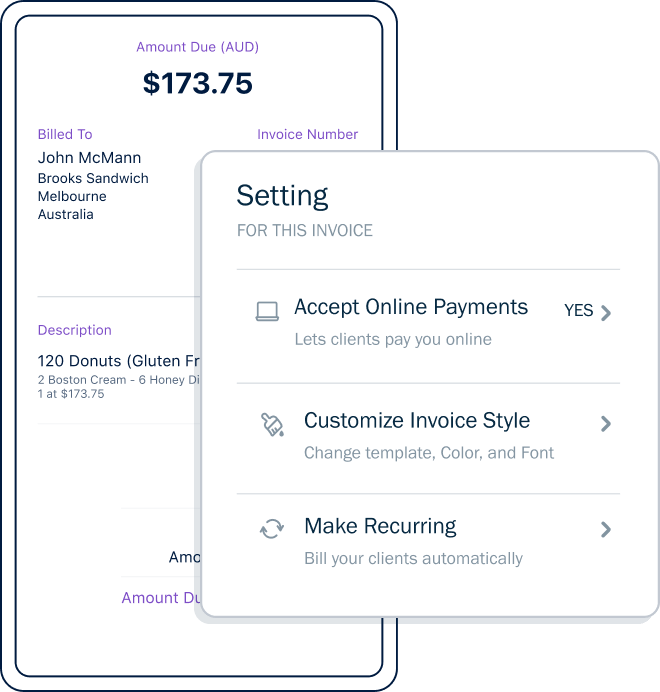

As a client, receiving a FreshBooks invoice with line items for subscription-based products or services, it’s easy to pay. All you have to do is save your credit card, banking, or other payment details online in the FreshBooks application so you’re automatically billed each time an invoice comes due. Imagine doing this without invoicing software—dealing with paper invoices and receipts and having to keep track of phone and address records separately.

Automatic Recurring Invoices in FreshBooks combined with Recurring Payments makes it simple for clients to pay and for you to accept payments for products or services rendered—hands-free. Recurring Payments works together with Recurring Templates to automatically bill clients every time an invoice is generated and sent.

Saved payment information can always be removed if you want to opt-out of Recurring Payments at any time.

Customizable invoices packed with billable hours and expenses, using advanced features like recurring subscription billing and online payments makes it easy for self-employed professionals to get paid faster.

When it comes to making online payments easy for you and your clients and comparing QuickBooks vs FreshBooks it’s easy to see why people choose FreshBooks.

You can import expenses from our expense tracker by uploading a CSV file as well as having FreshBooks automatically track them by connecting your bank accounts or credit cards.

If you want to import your expenses in bulk with a CSV file, you just need to ensure your file is populated with the necessary fields, and then select “Import Expenses from a File” from the “More Actions” button in the Expenses section of your FreshBooks account.

You can also connect your small business bank account and credit cards to your FreshBooks account to automatically track your expenses right in FreshBooks online accounting software.

You can easily test out expense tracking and importing during your 30-day free trial.

Related articles:

4 Reasons You Should Track Your Business Expenses Daily

Capture Expenses and Invoices on Project Pages in FreshBooks

Everything in your FreshBooks accounting software, from client time tracking to expense tracking to credit card information, is completely secure in FreshBooks.

FreshBooks protects your personal information. For the security of transactions, we use the Secure Sockets Layer (SSL) protocol, which encrypts any information such as credit card numbers and billing information that you send us electronically. The encryption process protects your information by scrambling it before it is sent to us from your computer. In addition, your data is backed up automatically and is accessible from any device, so you can always stay connected and up-to-date.

Want to learn more? Check out this article from our blog: How Secure Is Your Data in the Cloud?

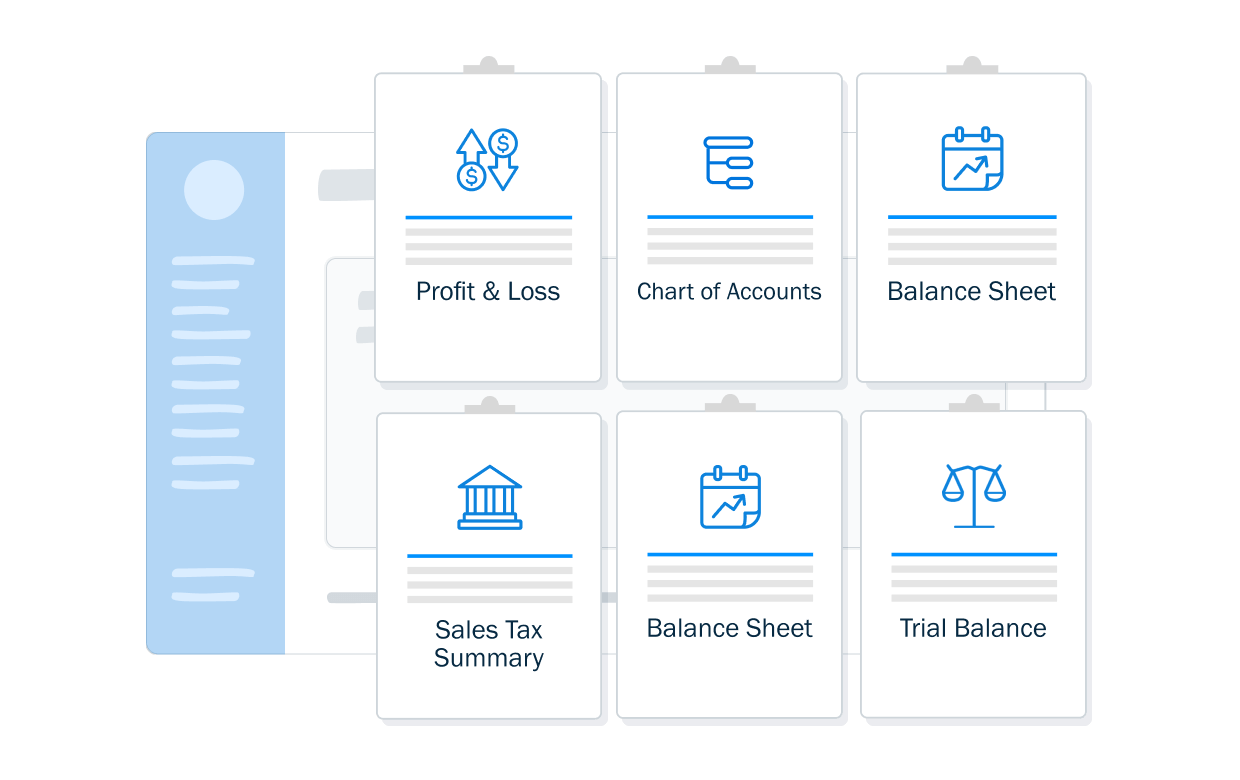

This is one of the biggest differences when comparing QuickBooks vs FreshBooks.

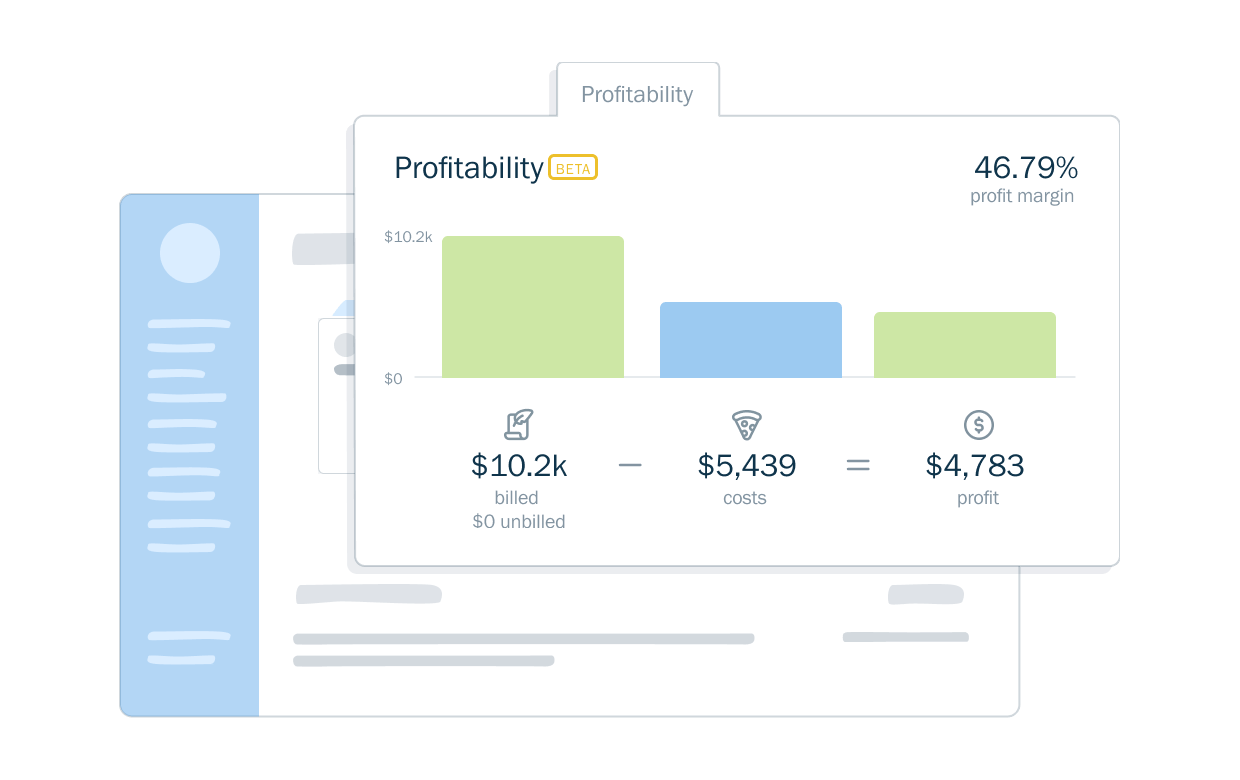

FreshBooks is a super-easy-to-use accounting software built specifically for small business owners, letting you easily do everything yourself. However, when it comes to using all the tools available to you as a small business owner, your accountant should definitely be part of your toolbox.

Sending customizable invoices and managing billing and invoicing for several businesses in FreshBooks might be right up your alley, but leveraging insights from accounting reports might be something you want a second set of eyes on.

Not only does FreshBooks small business accounting software allow you to add your accountant to your account, but FreshBooks also has an Accountant Partner Program that pairs you, the small business owner, with accountants. This ensures that businesses are matched with accountants that suit their specific needs.

Talk to your accountant and start a free trial to see how easy it is to work together. And if you need a hand, our phone support with a live rep extends to both you and your accountant with no additional fees.

One thing we recommend while comparing QuickBooks vs FreshBooks is to learn all about the FreshBooks Accountant Partner Program.

Want to hear what it’s like to be part of the Accountant Partner Program? Here’s a great article: How FreshBooks’ Accounting Partner Program Helps CMA Lindsay Support Clients

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge

Enlarge