Protect Your Profits and Your Time With Bookkeeping Services

Get 20% off Bench for your first 6 months

Bench saves me at least two to four hours per month, which translates to between $3,600 to $7,200 worth of my time back to focus on building the business.

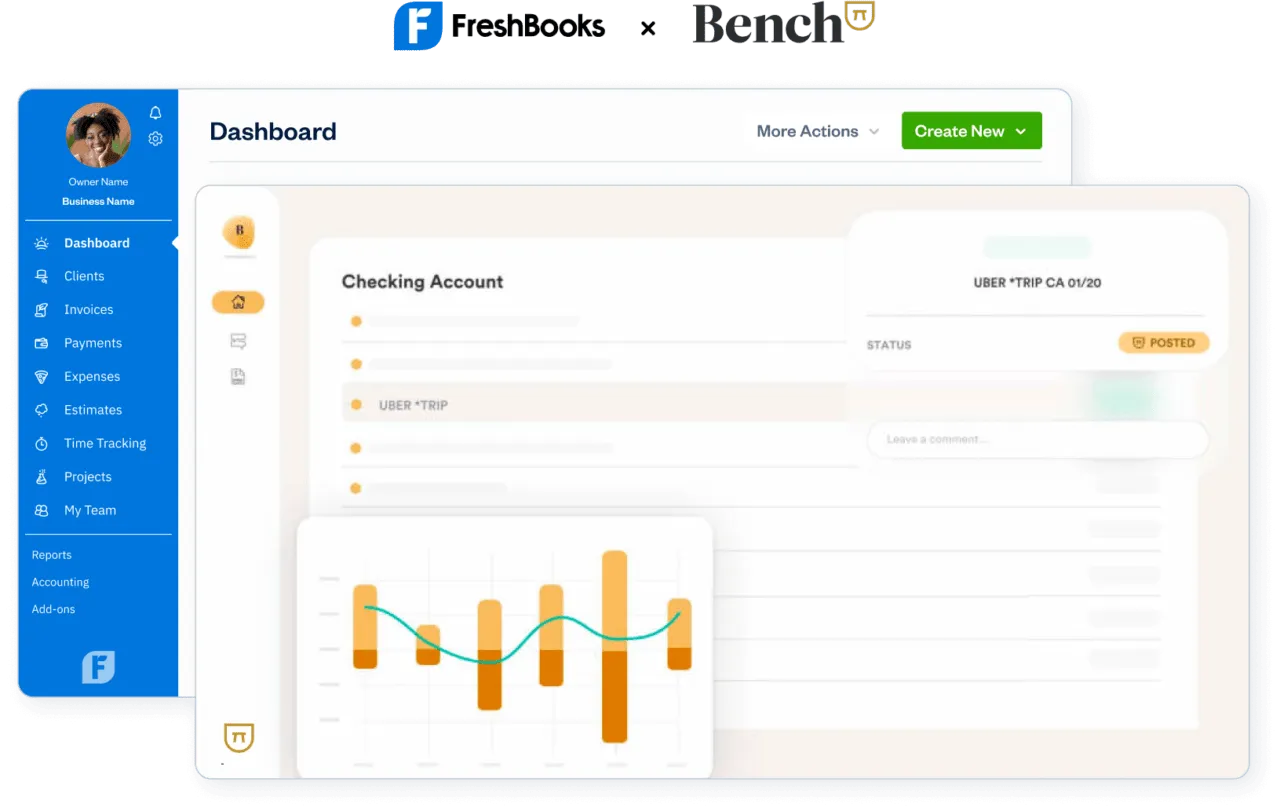

Expert Bookkeeping Services and Tax Prep

Bench provides bookkeeping services and tax filing designed for small businesses. When combined with FreshBooks, you’ve got a time-saving financial solution your business can count on.

Workflows to Keep Finances Flowing

Use FreshBooks for fast and easy invoicing and payments. Then let Bench handle your bookkeeping, track expenses, and maximize your tax deductions and returns.

Your Very Own Dedicated Bookkeeper

Bench online bookkeeping services connect you with real humans (your team of bookkeepers). These small business experts import bank statements, prepare monthly financial statements, and reconcile accounts.

Tax Season, Minus the Stress

FreshBooks tracks every dollar in, and Bench handles bookkeeping and tax prep…easy, right? Stress-free tax services and unlimited tax advisory keeps small businesses 100% compliant at tax time and year-round.

Know Your Business, Grow Your Business

FreshBooks accounting software and Bench virtual bookkeeping services ensure your books are up to date and give you a transparent view of your business’s health—making it easy to make smart financial decisions no matter what stage your business is at.

Are You an Accountant or Bookkeeper?

FreshBooks is built for small business owners, so (as an accountant, bookkeeper, or tax professional) you and your clients can work better together. The FreshBooks Accounting Partner Program lets you do just that.

WHAT ELSE?

Make Every Part of Bookkeeping Easier

Monthly Bookkeeping Services

Get organized transactions and expertly prepared financial statements each month.

Catch Up Bookkeeping Services

Work with expert bookkeepers to get your books up-to-date and ready to file—fast.

Bench Retro Bookkeeping Services

For more than two years of historical bookkeeping, letters from the IRS, years of unfiled back taxes, missing records, or anything else your business is facing.

Tax Advisory + Tax Filing Services

Get year-round bookkeeping and unlimited tax advisory support.

An AppStore for All of Your Business Needs

FreshBooks integrates and partners with over 100 other applications and add-on services. Easily integrate your account with other apps and partners to simplify everything from eCommerce to payroll services.

Have Lots of Clients and Want to Save on Billing?

Our FreshBooks Select Plan could be the solution for you, saving you time and money.

The Select Plan includes:

- Exclusive access to our Select Support and Onboarding teams to train your team and migrate your books from other platforms

- Access to lower credit card fees and transaction rates

- 2 free team member accounts

Some Extra Reading on How Bookkeeping Can Help Your Business

Get a newsletter that helps you think differently about your business

Frequently Asked Questions

This is a tricky question unless you’re an accountant or bookkeeper. These professions are very similar: Bookkeepers and accountants both work with financial data and help you manage your finances.

There’s also a blurring of roles, with some accountants providing bookkeeping services and some bookkeepers giving strategic business advice. Plus, today, most accounting software can create financial statements and financial reports—a task usually reserved for accountants.

Still, basic accounting functions and basic bookkeeping services are distinct, and there are many differences between accountants and bookkeepers and what they offer small business owners. Even the best online bookkeeping services for small businesses won’t do everything a dedicated accountant will or can.

Bookkeepers: Take care of the day-to-day financials. Bookkeepers post debits and credits, review the general ledger for accuracy, categorize expenses, and generate account statements.

Accountants: Take care of big-picture financial planning. Accountants use the updated information a bookkeeper provides to create financial models, analyze trends, prepare income taxes, and provide advice for growth.

Read this article for a quick summary of notable differences (and a few similarities) between bookkeeping services and accounting services.

Bench is FreshBooks’ top online bookkeeping services partner. They combine smart software with an affordable virtual bookkeeping professional who ensures your books are up-to-date every month. They also provide expert tax services, including tax advice, tax preparation, and tax filing, so you know your books are airtight come tax season.

A great bookkeeper ensures your books are 100% tax compliant, saving you time when filing taxes. They also make sure you don’t miss out on any possible deductions.

Hear firsthand how Bench and FreshBooks makes running a business and tax time a seamless experience in these 2 case studies:

How Virtual Bookkeeping Helped Jennifer Save Time and Feel Confident During Tax Season

How Recurring Billing Helps Trigg Manage Thousands of Payments a Month

It doesn’t matter how big or small your business is. If you feel like you’re spending too much time on bookkeeping that you could be spending on growing your business, a bookkeeper is perfect for you.

Check out this great article about online bookkeeping services for small business owners:

Top 5 Bookkeeping Mistakes U.S. Entrepreneurs Make, According to Bookkeepers

FreshBooks has more than a dozen Accounting reports, including Profit and Loss, Balance Sheet, Trial Balance, Accounts Aging, Revenue By Client, Accounts Payable Aging, Cash Flow, and General Ledger reports, plus Chart of Accounts.

Learn more about these reports in this descriptive yet simplified article.